Recently, the data research company Counterpoint released the "Report on the Domestic Smartphone Market in the Second Quarter of 2020." In the second quarter of 2020, China’s smartphone sales fell by 17% year-on-year, but from a month-on-month perspective, sales increased by 9% month-on-month, showing signs of recovery。

Affected by the epidemic, sales of domestic smartphones in the first quarter of this year were bleak. The report stated that in China, the epidemic has been well controlled, which has brought about the sales of smart phones, but the demand for smart phones has not yet returned to the level before the epidemic.

In the second quarter of this year, 5G mobile phones accounted for one-third of overall sales; in June, this proportion rose to 40%.

Speaking of the overall growth of China’s smartphone market, Zhang Mengmeng, a research analyst at Counterpoint Research, said: “Although commercial activities in China have resumed, consumer confidence remains low. Both OEMs and Chinese operators are reducing the price of 5G equipment and 5G. The plan is to actively promote 5G smartphones-this has increased the adoption rate of 5G, and one-third of the total smartphone sales this quarter were 5G devices, which is the most used device in the world-but this still cannot offset the overall market decline ."

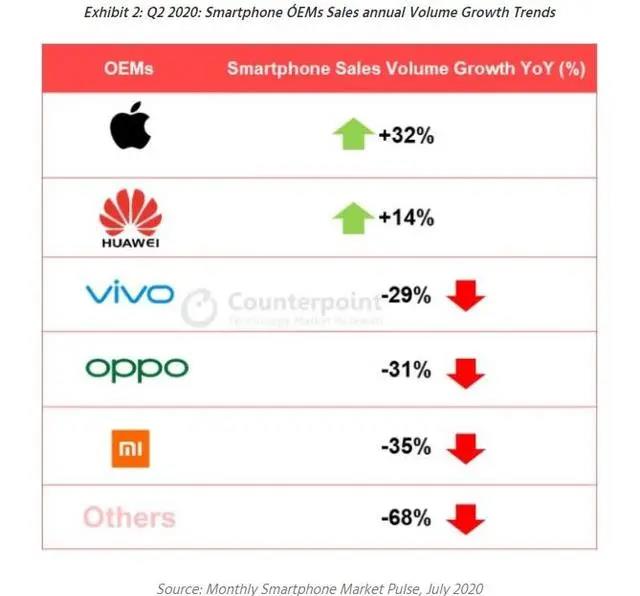

pecifically, in the second quarter of this year, Huawei was still the company with the largest domestic market share, accounting for 46% of the market share this quarter. The overall market growth rate slowed down, and Huawei still achieved a year-on-year growth of 14%。

Countpoint said that because Huawei lost the qualification to use GMS (Google Mobile Service) in the latest models, its overseas shipments have dropped sharply. China's domestic market is currently Huawei's most important market. Huawei's huge investment in expanding online and offline distribution networks has paid off. In addition, with the help of high-end Mate 30 and P40 series and mid-range Nova 7 series, Huawei's 5G product portfolio has grown rapidly.

Vivo and Oppo ranked second and third in this report, with market shares of 16% and 15%, but both fell year-on-year, down 29% and 31% respectively.

Apple ranked fourth with a market share of 9%, an increase of 34% year-on-year; Xiaomi ranked fifth with a market share of 9%, but a year-on-year decrease of 35%. In addition, the market share of other small factories was squeezed again, down 68% year-on-year.

Despite the market decline, due to the continued popularity and price cuts of the iPhone 11 series, Apple still grew by 32% year-on-year, and iPhone SE also entered the list of the three most popular iPhones in the second quarter of this year. Driven by the surge in sales of Xiaomi, June is the best month for smartphone sales so far this year.

In general, with the exception of Huawei and Apple, sales of other brands in the domestic smartphone market declined in the second quarter. Xiaomi achieved a counterattack in June this year, but sales in the second quarter still fell year-on-year.

Counterpoint emphasized that despite the slowdown in the growth rate of the Chinese smartphone market, Chinese OEMs have accelerated the pace of 5G development. These developments were affected by the epidemic in the first quarter of 2020. However, the number of smart phones sold in the second quarter was compared with the first quarter. 33% of mobile phones support 5G, which is only 16% in the first quarter. Judging from the data in June, China's 5G smartphone market has been quite consolidated. Although the current price of 5G mobile phones is 400 U.S. dollars and above, there is a trend toward a lower price range.